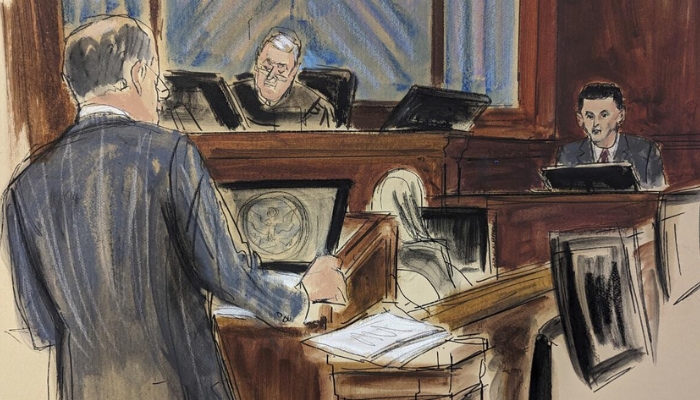

Sam Bankman-Fried Crypto Fraud Trial

Anúncios

Former crypto billionaire Sam Bankman-Fried recently faced a judge and jury as he stands trial for criminal fraud. The 31-year-old entrepreneur, who could potentially face a lifetime behind bars if convicted on all seven fraud counts, has been the center of attention in a high-profile case. Prosecutors allege that Bankman-Fried’s crypto exchange, FTX, was founded on deceit, accusing him of siphoning funds from customers to fund his lavish lifestyle and to support political campaigns in the United States.

Bankman-Fried’s defense team contends that he was just another entrepreneur navigating the unpredictable landscape of business, arguing that it is not a crime to lead a company that later encounters financial troubles and potential bankruptcy. Following a day of testimony, the former CEO is set to return to the witness stand for another round of questioning.

In the courtroom, much has been made of Bankman-Fried’s laid-back appearance, characterized by casual attire and his unruly mop of curly hair. During the trial, Caroline Ellison, Bankman-Fried’s ex-girlfriend and the former CEO of Alameda Research, suggested that his appearance was part of a deliberate marketing strategy to portray him as a quirky startup founder. However, Bankman-Fried brushed off these claims, stating that he dressed comfortably and had simply been too busy to get a haircut for extended periods. He emphasized that he never intended to become the public face of FTX, labeling it an accidental role.

Bankman-Fried’s testimony has emphasized his belief that executives at FTX and Alameda often operated independently without his direct supervision. He admitted his lack of programming skills and mentioned that he was not entirely aware of the alleged “back door” that Alameda used to withdraw FTX customer funds, a key focal point in the case.

When Bankman-Fried co-founded FTX with Gary Wang in 2019, he believed that their design philosophy could revolutionize the crypto exchange market, which he considered clunky and nonsensical at the time. Initially contemplating selling FTX to Binance, Bankman-Fried’s perspective changed as he became more confident in FTX’s potential to attract customers. He admitted that he once thought there was only a 20% chance of success but deemed it a significant opportunity, given the dominance of multi-billion-dollar exchanges at the time.

In a surprising revelation, Bankman-Fried testified about FTX’s journey to secure a brand partnership with an arena. While they eventually partnered with the Miami Heat’s home arena in a significant deal, they explored options with the New Orleans Saints and the Kansas City Chiefs’ football stadiums, as well as the Kansas City Royals’ baseball stadium. However, he humorously noted, “No offense to the Kansas City Royals, but we didn’t want to be known as the Kansas City Royals of crypto exchanges.”

During the trial, Judge Lewis Kaplan expressed frustration with Bankman-Fried’s responses, particularly when questioned by prosecutors. The judge urged Bankman-Fried to answer questions directly and noted his tendency to provide vague responses. Despite the legal complexities, the trial continues to unravel the intricacies of the case against the former crypto billionaire.

See also: Consumer Spending and Corporate Concerns