Apply for a JPMorgan Chase Credit Card

Anúncios

Welcome to the world of JPMorgan Chase Credit Cards, where financial possibilities are boundless. Whether you’re looking for rewarding cashback offers, exclusive travel perks, or enhanced security features, JPMorgan Chase has a credit card tailored to suit your needs. In this article, we will delve into the seamless process of applying for a JPMorgan Chase credit card, explore the enticing benefits they offer, and discover the advantages of being a cardholder with one of the world’s leading financial institutions.

JPMorgan Chase has earned a reputation for excellence in the banking industry, and their credit cards are no exception. With a range of options available, each credit card is designed to cater to diverse financial lifestyles, empowering customers to achieve their financial goals while enjoying a plethora of rewards and benefits. Whether you’re a frequent traveler, a savvy shopper, or simply seeking a reliable credit card for everyday use, JPMorgan Chase has you covered. So, let’s embark on this journey to explore the features and advantages of their credit card offerings, providing you with valuable insights to make informed financial decisions.

Step-by-Step Guide to Applying for a JPMorgan Chase Credit Card:

To apply for a JPMorgan Chase credit card, follow these simple steps: visit their official website, fill out the online application form with your personal and financial information, and submit it for review. Once approved, you will receive your shiny new card, ready to unlock a world of financial possibilities.

- Research and Comparison: Begin by researching the various credit card options offered by JPMorgan Chase. Visit their website or a local branch to gain insights into the different types of cards available, including rewards cards, cashback cards, travel cards, and more. Compare their features, benefits, and associated fees to select the one that aligns best with your financial goals and lifestyle.

- Online Application: Once you’ve decided on the ideal credit card, proceed with the application process. Head to the JPMorgan Chase website, where you can easily fill out an online application form. Provide the necessary personal information, including your name, contact details, social security number, and annual income. The bank’s secure website ensures the confidentiality of your data.

- Financial Assessment: After submitting your application, the bank’s team will review your financial background, credit history, and income details. This evaluation helps JPMorgan Chase determine your creditworthiness and assess the credit limit that can be granted to you. This step is vital in ensuring responsible lending practices and matching you with the most suitable card.

- Card Approval and Delivery: Once your application is approved, you will receive a notification from JPMorgan Chase. Congratulations, you’re now a proud owner of a JPMorgan Chase credit card! The bank will deliver the physical card to your registered address, usually within a few business days.

[su_button url=”https://www.jpmorganchase.com” style=”flat” background=”#184ca1″ size=”15″ icon=”icon: credit-card-alt”]APPLY FOR A J.P.MORGAN CHASE CREDIT CARD[/su_button]

Benefits of JPMorgan Chase Credit Cards:

Rewards Program:

JPMorgan Chase credit cards come with lucrative rewards programs that let you earn points or cashback on every purchase you make. These rewards can be redeemed for travel, merchandise, gift cards, and more, making your card usage even more fulfilling.

Travel Perks:

For avid travelers, JPMorgan Chase offers credit cards with excellent travel benefits. From travel insurance and airport lounge access to travel statement credits, these cards enhance your travel experience while providing peace of mind.

Zero Liability Protection:

JPMorgan Chase prioritizes the security of its cardholders, offering zero liability protection against unauthorized transactions. If your card is used fraudulently, you won’t be held responsible for any charges.

Exclusive Offers:

Being a JPMorgan Chase credit cardholder grants you access to exclusive offers and discounts from partner merchants and brands. Enjoy special deals on dining, shopping, entertainment, and more.

Advantages of Holding a JPMorgan Chase Credit Card

JPMorgan Chase credit cards offer financial flexibility, allowing you to make purchases and defer payments, empowering you to manage expenses effectively and build a strong credit history.

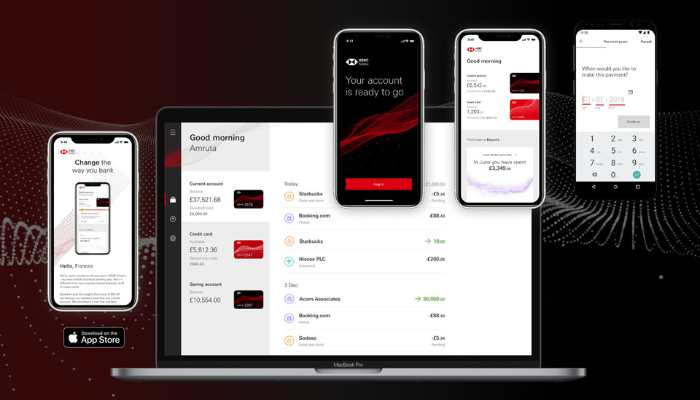

Moreover, the seamless integration of their mobile app ensures convenient digital banking, enabling you to access your credit card account effortlessly. From checking balances and viewing transactions to setting alerts and making payments, all these features are conveniently available at your fingertips

Conclusion:

In conclusion, the JPMorgan Chase credit card provides a powerful financial tool for individuals seeking flexibility, convenience, and security in their spending habits. With its user-friendly mobile app and robust fraud protection measures, customers can confidently manage their credit card accounts and stay in control of their finances.

Furthermore, the array of benefits and rewards offered by JPMorgan Chase ensures that cardholders can make the most of their spending, earning valuable points, cashback, and other incentives. Whether it’s for everyday expenses or special purchases, the JPMorgan Chase credit card proves to be a reliable and valuable companion for individuals looking to optimize their financial management and enhance their overall banking experience.

See also: Apply for a Bank of America Credit Card

[su_button url=”https://www.jpmorganchase.com” style=”flat” background=”#184ca1″ size=”15″ icon=”icon: credit-card-alt”]APPLY FOR A J.P.MORGAN CHASE CREDIT CARD[/su_button]