Wall Street: Housing Market Flourishes Amid Rising Rates and Strong Demand

Anúncios

Despite witnessing mortgage rates reaching their highest levels in decades and experiencing concerns in the bond market, the housing market is witnessing robust demand for new homes, leading to an upward trend in prices. This phenomenon has captured the attention of Wall Street, as experts exhibit a positive outlook on the sector’s future despite various economic uncertainties.

The housing market remains a resilient entity, standing in contrast to the divergent opinions circulating on the U.S. economy’s vulnerability to a recession. The Federal Reserve’s recent meeting minutes, released on Wednesday, highlight ongoing focus on inflation. However, central bank economists have reevaluated their earlier projections of an economic downturn. Interestingly, the housing market seems to be immune to the looming “R” word, recession.

Remarkably, despite the surge in borrowing costs, demand for homes remains strong. Recent months have witnessed an upward trajectory in house prices across various regions of the country, and this trend is expected to persist. Goldman Sachs, a prominent financial institution, has even revised its home-price forecast, indicating that the average closing price is projected to rise by 1.8 percent by the end of the year. This adjustment is a significant departure from their earlier prediction of a 2.2 percent decline. Furthermore, Goldman Sachs predicts that home prices will continue to rise in the following year, largely due to the constrained housing supply.

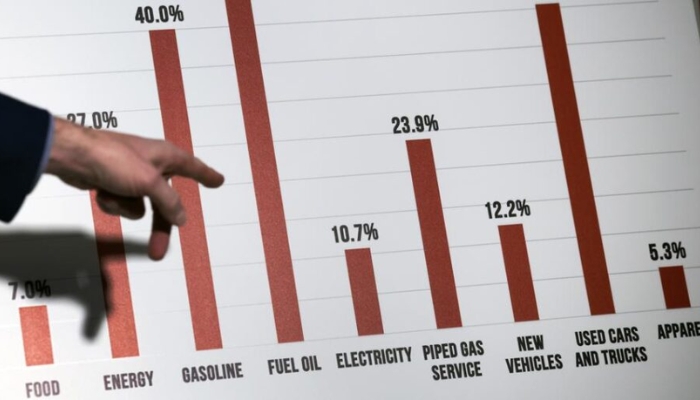

Contrary to earlier predictions of a prolonged housing market slump, these fears have not materialized. The Federal Reserve, with its vigilant approach, has been diligently addressing inflation concerns as observed by Wall Street, by raising borrowing costs, ultimately driving mortgage rates to a 22-year high. Bankrate data indicates that the average rate for a new 30-year mortgage reached 7.31 percent this week, nearly doubling since the Fed initiated rate hikes in March 2022. Consequently, the monthly mortgage payments for typical homebuyers now exceed $2,600, a debt level that is causing concern among market observers.

Goldman Sachs strategists Roger Ashworth and Vinay Viswanathan expressed apprehension over homebuyers’ behavior in the face of elevated mortgage rates. They noted that the average debt-to-income ratio on conforming purchase mortgages has exceeded 38 percent, a significant deviation from post-Global Financial Crisis norms. The housing affordability index developed by Goldman Sachs recently hit its lowest level in its 25-year history, underscoring the challenges posed by the current market dynamics.

The possibility of mortgage relief appears elusive as the futures market reflects increased odds of further rate hikes after the release of the Fed minutes. Additionally, rising yields on the 10-year Treasury note have captured significant attention, given that mortgage rates tend to rise in tandem with this indicator. As the yield reached levels last observed in 2008, during a period when the housing market experienced a collapse, concerns have been raised about a potential global crisis.

In a notable contrast, Wall Street remains optimistic about the housing market’s prospects. Shares of homebuilders have experienced significant gains this year, with even major players like Warren Buffett’s Berkshire Hathaway placing substantial bets in the sector. However, the commercial real estate market tells a different story. The segment is confronting more precarious conditions due to factors like post-pandemic office vacancies, rising interest rates, and anticipated renegotiations for commercial mortgages in the coming years. This situation particularly impacts regional banks that are heavily exposed to the commercial real estate market.

In summary, Wall Street’s enthusiasm for the housing market persists despite challenging economic conditions, as evidenced by rising mortgage rates and bond market uncertainties. The strong demand for new homes and the upward trend in prices have solidified the market’s resilience, inspiring confidence among investors and experts alike.

See also: With Investors on Edge, Fed Minutes Gain Heightened Importance