Is Nvidia ‘s Meteoric Rise Sustainable?

Anúncios

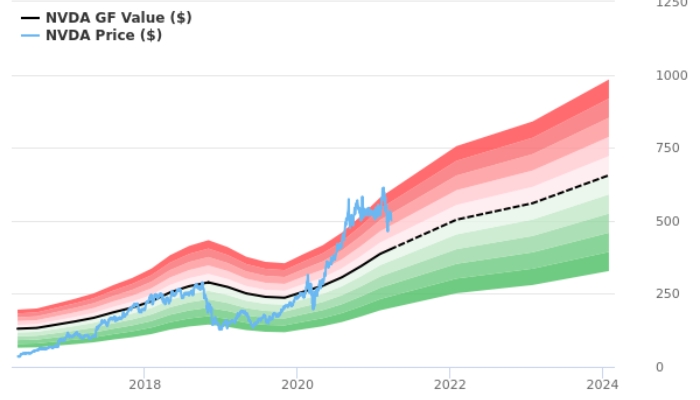

It’s been a stellar year for Nvidia, with its shares skyrocketing by an impressive 220%, securing its position as the top-performing S&P 500 stock in 2023. The chipmaking giant recently reported robust third-quarter earnings, boasting a 34% increase in revenue from the previous quarter and a remarkable 206% surge from the same period last year. The company’s optimistic guidance, projecting around $20 billion in revenue for the final quarter, surpassed analysts’ expectations of $17.8 billion.

However, behind the façade of success, concerns are emerging on Wall Street. Executives at Nvidia have reportedly sold or expressed intentions to sell a collective 370,000 shares, amounting to approximately $180 million in November alone. If all registered shares for sale are executed, November 2023 would mark the highest monthly value of stocks sold by insiders in the company’s history.

Behind the Numbers: Q3 Earnings and Executive Actions

Just before Thanksgiving, Nvidia reported impressive third-quarter earnings, showcasing a 34% increase in revenue from the previous quarter and a remarkable 206% surge from a year ago. However, concerns arise as company executives reportedly sold a substantial number of shares in November, totaling about $180 million.

[su_button url=”https://www.growcredit.com/” style=”flat” background=”#ff9900″ size=”15″ icon=”icon: credit-card-alt”]DISCOVER THE GROW CREDIT MASTERCARD[/su_button]

Headwinds and Challenges

New restrictions on chip exports to China and uncertainties about the company’s ability to sustain such exponential growth contribute to a sense of caution on Wall Street. Nvidia’s CFO, Colette Kress, acknowledged the negative impact of export controls on the company’s China business, adding an element of unpredictability to future profits.

Nvidia’s Future in the AI Gold Rush

While doubts linger about the sustainability of Nvidia’s meteoric rise, the company has strategically positioned itself in the AI space. Embracing the AI trend akin to its success in the crypto era, Nvidia executives emphasized the term “AI” more than 70 times in their recent earnings call, according to Steve Sosnick, chief strategist at Interactive Brokers. Sosnick likens Nvidia’s role to selling “picks and shovels” during the AI gold rush.

Analysts, including those at Goldman Sachs, foresee a 34% upside for Nvidia over the next 12 months, with a price target of $625 per share. This bullish outlook is supported by the belief that AI represents the most transformative technology trend since the internet’s inception in 1995. Nvidia is positioned to lead the way in monetizing the expected $1 trillion AI spend over the next decade, according to Dan Ives of Wedbush.

However, not everyone shares this optimism. Some, like Sarat Sethi, managing partner at DCLA, argue that Nvidia needs to maintain a staggering 30% growth rate annually to sustain its current valuation. As uncertainties persist and competition looms, the volatility of Nvidia’s stock raises cautionary flags among investors.

In conclusion, Nvidia’s journey into 2024 is poised at a crossroads. While the company continues to ride the wave of AI enthusiasm, challenges, and uncertainties on multiple fronts prompt a closer examination of its sustainability in the ever-evolving tech landscape.

See also: Purdue Pharma’s Opioid Settlement: Supreme Court Dilemma

[su_button url=”https://www.growcredit.com/” style=”flat” background=”#ff9900″ size=”15″ icon=”icon: credit-card-alt”]DISCOVER THE GROW CREDIT MASTERCARD[/su_button]