The Challenges of Startup Funding in 2023

Anúncios

The landscape of startup funding in 2023 is undergoing a profound transformation, presenting challenges that extend beyond entrepreneurs to impact the very investors who once fueled the tech boom. In a departure from the years of abundance, startups are grappling with a funding drought as venture capitalists, angel investors, and tech evangelists adopt a more cautious stance amid economic uncertainties and banking crises.

[su_button url=”https://www.growcredit.com/” style=”flat” background=”#ff9900″ size=”15″ icon=”icon: credit-card-alt”]DISCOVER THE GROW CREDIT MASTERCARD[/su_button]

The industry that once welcomed any idea coupled with buzzwords like ‘blockchain’ or ‘AI’ is now facing reduced valuations, a scarcity of funds for early-stage ventures, and a dearth of exit opportunities for late-stage companies.

The Funding Crunch and Shifting Priorities

The allure of high-risk startups is fading as investors reevaluate their strategies in the face of economic uncertainties. The once open tap of easy cash for tech startups has been significantly tightened. Safer investments, exemplified by the impressive performance of the Bloomberg US Aggregate bond index, are now gaining favor.

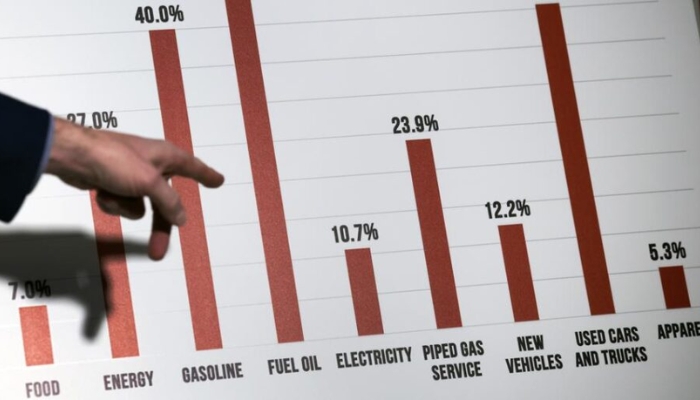

The risks associated with startups, coupled with an uncertain economic environment, prompt investors to seek better returns in less risky money markets. This shift in priorities has led to a 50% drop in global venture capital funding compared to the previous year.

The Extinction-Level Event for Startups

Startups find themselves caught in a financial storm, with both early and late-stage companies grappling with challenges. The lack of funds and exit opportunities has stifled innovation, rendering early-stage companies unable to take flight and pushing late-stage companies into financial distress.

According to equity management company Carta, nearly 20% of startups in 2023 raised funds at lower valuations than in 2022, signaling a significant decline in investor confidence. The third quarter of 2023 witnessed the closure of more startups than in any comparable period in the past five years.

The Bleak Landscape and Record “Dry Powder”

The startup landscape is marked by closures and bankruptcies, with industry giants like WeWork and Convoy succumbing to financial woes. The situation has prompted industry insiders to label it an “extinction-level event” for startups.

However, amidst the bleakness, venture capitalists find themselves sitting on a record amount of “dry powder,” representing capital that’s been committed but is still awaiting deployment. This surplus indicates a readiness to pounce on the right opportunities when they arise.

Seeking Opportunities Amidst Uncertainty

While startup funding and exit strategies face challenges in the short term, there are promising signs within specific sectors. Artificial intelligence (AI) and biotech funding continue to show resilience, offering beacons of hope amid the broader challenges.

Initial public offerings (IPOs) are slowly regaining momentum, and the venture scene in Europe is witnessing some promising fundraising activities. Despite the overall cautious sentiment, investors and analysts are keeping a watchful eye on potential opportunities for growth and innovation.

Conclusion

As 2023 draws to a close, the startup ecosystem reflects on a year marked by unprecedented challenges. The evolution of startup funding is indicative of a broader shift in the investment landscape, prompting a reevaluation of risk appetites and investment strategies. The challenges faced by startups serve as a cautionary tale, urging both entrepreneurs and investors to adapt to the changing dynamics.

While uncertainties persist, the resilience displayed by certain sectors and regions hints at a future where innovation and growth may still thrive. As investors navigate these uncharted waters, the lessons learned in 2023 will likely shape the trajectory of startup funding in the years to come.

See also: Bitcoin, Gold, and Market Dynamics

[su_button url=”https://www.growcredit.com/” style=”flat” background=”#ff9900″ size=”15″ icon=”icon: credit-card-alt”]DISCOVER THE GROW CREDIT MASTERCARD[/su_button]