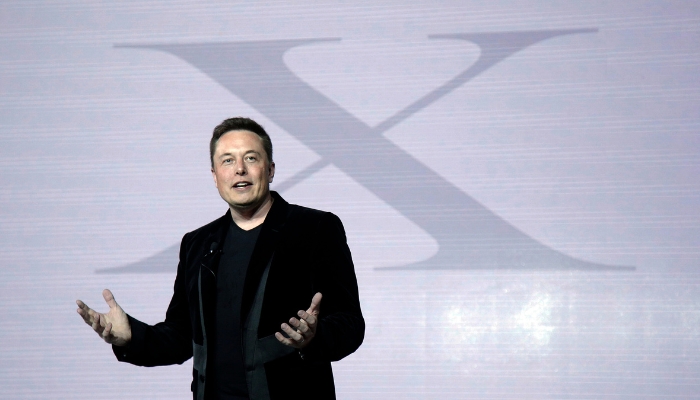

Tesla’s Board Dynamics: Ties and Market Implications

Anúncios

Musk’s Controversial Pay Package Rejection

The recent plummet of Tesla’s stock by nearly 4% following the Wall Street Journal’s exposé on Elon Musk’s close ties with board members raises significant concerns among investors. This revelation comes on the heels of a Delaware Chancery Court judge’s decision to strike down Musk’s unprecedented, multibillion-dollar pay package, deeming the approval process deeply flawed due to the close relationships within the board.

[su_button url=”https://www.capitalone.com/credit-cards/venture/” style=”flat” background=”#184ca1″ size=”15″ icon=”icon: credit-card-alt”]APPLY FOR A CAPITAL ONE VENTURE CARD[/su_button]

Board Independence Under Scrutiny

Judge Kathaleen McCormick, in her ruling, highlighted the lack of independence among the board members responsible for negotiating Musk’s pay. Personal and financial relationships were emphasized, particularly with key figures such as Ira Ehrenpreis and Antonio Gracias. Ehrenpreis, a close friend of Kimbal Musk (Elon’s brother and a Tesla board member), has invested “tens of millions of dollars” in Musk-controlled companies. Gracias, another board member, shares both business and personal ties with Musk, spending Christmas together and enjoying regular vacations.

Unveiling Personal Connections

The intricate web of personal connections extends further, with Ehrenpreis attending Kimbal Musk’s wedding in Spain and investing in Kimbal’s restaurant company, The Kitchen Group. Gracias, in addition to his vacationing with Musk’s family, acquired “dynastic or generational wealth” through investments in Musk’s companies. These revelations shed light on the blurred lines between professional and personal relationships within Tesla’s board.

Impact on Tesla’s Market Position

The revelation of these close ties has sparked concerns about the independence of Tesla’s board, especially as it relates to overseeing one of the world’s most powerful CEOs. The Nasdaq’s requirement for an independent director, free from relationships that may interfere with independent judgment, prompts questions about the effectiveness of Tesla’s governance. This scrutiny coincides with a challenging period for Tesla’s stock, down nearly 30% this year. Piper Sandler’s decision to cut its Tesla stock price target added to the market’s skepticism, suggesting potential hurdles for the company’s growth in the upcoming year.

Market Repercussions and Skepticism

The controversy surrounding Musk’s ties with Tesla’s board is not entirely new, but the recent Wall Street Journal report and the Delaware court’s ruling provide fresh insights into the dynamics at play. Investors, particularly wealth managers, find reasons to reassess their positions, leading to a decline in Tesla’s stock value. Elon Musk’s actions and the revelations about board ties contribute to the growing skepticism surrounding Tesla’s growth narrative.

Governance Challenges

Tesla, known for its innovative approach and disruptive influence on the automotive industry, now faces scrutiny over its governance practices. As revelations about close ties between Musk and board members continue to emerge, the company must address concerns surrounding independence and transparency. Navigating these governance challenges is crucial for restoring investor confidence and securing Tesla’s position in the market. The evolving narrative around Tesla’s board dynamics underscores the broader issues of accountability and oversight in corporate governance.

See also: Global Banks Navigate Choppy Waters

[su_button url=”https://www.capitalone.com/credit-cards/venture/” style=”flat” background=”#184ca1″ size=”15″ icon=”icon: credit-card-alt”]APPLY FOR A CAPITAL ONE VENTURE CARD[/su_button]