Overdraft Fee Overhaul

Anúncios

Closing the Overdraft Loophole

The Consumer Financial Protection Bureau (CFPB) has set its sights on overhauling the overdraft fee landscape, proposing a rule that could bring about transformative changes in how large banks and credit unions handle overdraft fees. With the potential to save consumers up to $3.5 billion annually, the proposed rule specifically targets financial institutions with assets exceeding $10 billion, a group that constitutes a substantial portion of deposit account customers in the United States.

[su_button url=”https://www.capitalone.com/credit-cards/venture/” style=”flat” background=”#184ca1″ size=”15″ icon=”icon: credit-card-alt”]APPLY FOR A CAPITAL ONE VENTURE CARD[/su_button]

Loopholes Exploited for Years

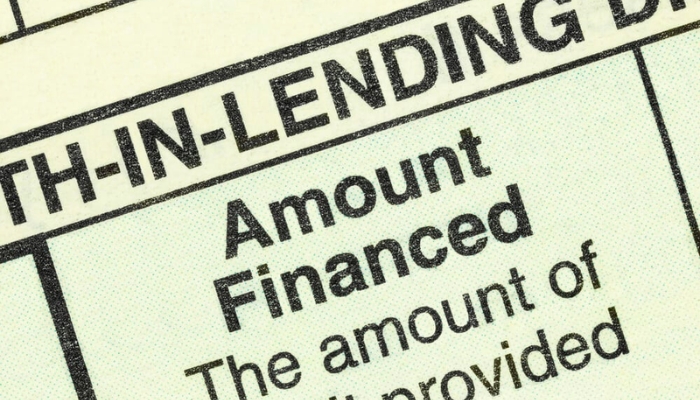

The CFPB’s move comes as a response to a long-standing loophole that has allowed large banks to exploit overdraft fees, turning them into a lucrative revenue stream. Many customers find themselves unwittingly subject to a $35 charge for overdraft loans, even when the overdraft amount is less than $26 and repaid within three days. The proposed rule seeks to address this issue by bringing overdraft protection under the purview of the Truth in Lending Act, requiring clear disclosures similar to those mandated for credit cards.

Protecting Consumers and Cutting Costs

The CFPB estimates that around 23 million households pay overdraft fees annually, with the proposed rule holding the potential to save each household approximately $150 per year. This initiative is part of the broader efforts by the Biden Administration to reduce “junk fees” across various industries, enhancing transparency and fairness. President Biden has voiced support for the proposed rule, emphasizing its potential to save families billions while addressing what he describes as exploitative fees.

Industry Response and Potential Impact

However, major banking trade groups have pushed back against the proposed rule, arguing that it could undermine years of progress, innovation, and competition in the banking sector. Industry representatives caution that consumers might be adversely affected if the rule is enacted, as it may limit access to overdraft protection. Anticipating legal challenges, industry leaders question the CFPB’s authority to subject overdraft services to Truth in Lending Act regulations and impose pricing caps. The future impact on banking practices and consumer access to overdraft protection remains uncertain.

Crafting a Balanced Approach

As the proposed CFPB rule navigates the public comment period until April 1, the financial industry, regulators, and consumer advocates will closely monitor the potential implications for both financial institutions and deposit account holders. Striking a balance between protecting consumers from excessive overdraft fees and allowing banks to offer viable overdraft protection solutions is a central theme. The outcome of this regulatory initiative may shape the landscape of overdraft practices, emphasizing the need for transparency and fairness in consumer financial services.

A Pivotal Moment for Overdraft Practices

The proposed CFPB rule represents a pivotal moment in the ongoing efforts to reform overdraft practices and enhance consumer protections. As stakeholders engage in discussions and provide feedback during the public comment period, the financial industry may witness significant shifts in how overdraft fees are structured and disclosed. The regulatory landscape is evolving, and the finalization of the proposed rule could usher in a new era for consumer banking, placing emphasis on fair practices and cost-saving measures for households across the nation.

In conclusion, the CFPB’s proposed rule marks a significant step towards protecting consumers from exorbitant fees, fostering transparency, and redefining banking practices. While the banking industry expresses concerns, the potential savings for households and the broader effort to eliminate exploitative practices highlight the importance of continued regulatory scrutiny. As public discourse unfolds during the comment period, the outcome will shape the landscape of consumer financial protection, influencing how banks balance innovation, competition, and the well-being of their customers.

See also: Boeing: Safety Audit and Quality Concerns

[su_button url=”https://www.capitalone.com/credit-cards/venture/” style=”flat” background=”#184ca1″ size=”15″ icon=”icon: credit-card-alt”]APPLY FOR A CAPITAL ONE VENTURE CARD[/su_button]