Destiny Mastercard: Optimize Your Finances

Anúncios

Managing your finances effectively demands reliable tools that align with your lifestyle needs and financial goals. The Destiny Mastercard emerges as a practical credit card solution, offering you the convenience of handling your financial activities online.

With its online banking capabilities, you have 24/7 access to your account, allowing you to stay on top of your transactions, balances, and payments.

By setting up an online bank account with Destiny Mastercard, you make financial management straightforward and secure. The process is designed to be user-friendly, ensuring that whether you’re making a payment, reviewing your statement, or just checking recent transactions, it can all be done with just a few clicks. The online platform also simplifies the application process, giving you the opportunity to join the Destiny Mastercard community without undue hassle.

Destiny Mastercard Features and Benefits

Credit Building Opportunities

Your responsible use of the Destiny Mastercard can aid in building your credit history. This is crucial for future financial activities such as applying for loans or additional credit. Regular reporting to the major credit bureaus ensures your credit activity is documented.

Online Account Management

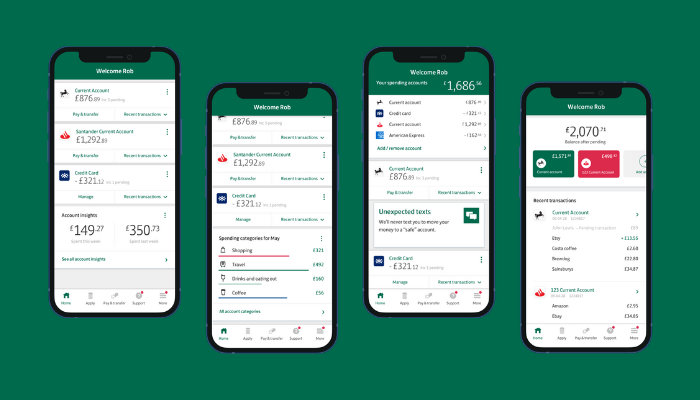

Managing your finances is made straightforward with the online account management features of the Destiny Mastercard. You can readily monitor transactions, view statements, and schedule payments, which is vital for staying on top of your bank interactions and budget.

Security and Fraud Protection

Security measures are implemented to safeguard your Destiny Mastercard. Fraud protection is a key aspect that allows you to have peace of mind. Should suspicious activities arise, the bank’s security protocols are designed to protect your account.

Fees and Charges

Be aware of the fees and charges associated with the Destiny Mastercard, which can influence the overall cost of maintaining the card. It’s important to remain cognizant of the annual fee, APR, and any other applicable charges as part of your financial management.

Setting Up and Using Your Online Bank Account

Managing your finances effectively requires a solid understanding of how to set up and use your online bank account. With the Destiny Mastercard, you’ll have secure and convenient access to banking services at your fingertips.

Registration and Activation

To begin using your Destiny Mastercard online bank account, you need to register and activate your account. First, visit the Home Page – Destiny Mastercard and look for the registration or sign-up option. You will be prompted to provide personal details and your card information. After submitting this information, your account will be set up, and you can activate it by following the instructions sent to your email or via an SMS to your registered phone number.

Navigating the Online Portal

Your Destiny Credit Card Login grants you access to all the features of your online account. Upon logging in, you’ll be able to view account balances, transaction history, and e-statements. The portal is designed for ease of navigation, allowing you to find transactions, update personal details, or contact customer support with minimal effort.

Mobile Banking Capabilities

For banking on the go, the Destiny Mastercard provides you with mobile banking capabilities. You can access the same features as the online portal on your smartphone or tablet, ensuring you can manage your finances wherever you are. While the search results did not specify a mobile app, it’s common for bank accounts linked to such Mastercards to offer a dedicated app for enhanced user experience.

Making Payments and Transfers

With your Destiny Mastercard online bank account, making payments and transfers is straightforward. You can pay your Destiny Card bill through various methods such as online payment, phone payment, or mail payment. Setting up automatic payments can ensure you never miss a due date. Additionally, you’ll be able to transfer funds to other accounts if your bank provides this service within the user portal.

See too New Rule Caps Credit Card Late Fees.