Absa Credit Card Gold: Benefits and Application Process

Anúncios

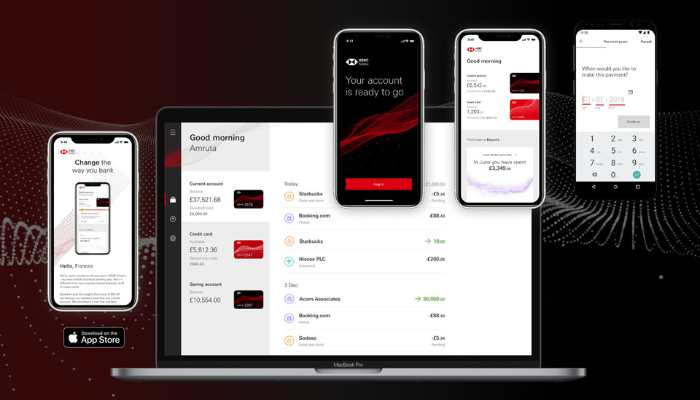

The Absa Gold Credit Card is an excellent choice for those seeking a mix of practicality and lifestyle benefits. Cardholders enjoy perks such as cash back, interest-free periods, and travel insurance, making it a versatile financial tool.

These benefits are part of Absa’s efforts to offer more value through their credit card options, ensuring money is readily available for both planned and unexpected expenses.

Additionally, the card supports various features like contactless payments and airport lounge access, enhancing the overall user experience. With its widespread acceptance, users can conveniently use the card for everyday purchases and earn rewards globally. The Absa Gold Credit Card stands out as a worthwhile consideration for anyone looking to maximize their purchasing power and enjoy added lifestyle benefits.

Features and Benefits

The Absa Gold Credit Card offers a range of attractive features such as a reward program that provides cash back, competitive interest rates, and efficient credit limit management options. These features enhance the cardholder’s financial flexibility and enrich the user experience.

Rewards Program

The Absa Gold Credit Card comes with a robust rewards program that significantly enhances its appeal. Cardholders can earn up to 30% cash back on everyday purchases, providing substantial savings opportunities. Additionally, the card offers travel benefits including discounts on flights and accommodation, which are ideal for frequent travelers. Engaging with Absa Rewards can also grant access to exclusive dining and lifestyle offers, such as free meals for completing challenges with the Absa mobile app. This comprehensive rewards structure makes it a compelling choice for users seeking both value and benefits.

Interest Rates and Fees

The interest rates associated with the Absa Gold Credit Card are competitive within the market. Absa offers transparency in its fee structure, ensuring cardholders are fully aware of costs, including any monthly charges. By opting for the 3-in-1 Gold Package, users can benefit from a combined offering that waives the monthly credit card fee. This bundled package not only reduces costs but also enhances financial convenience by integrating banking services. Understanding the interest rates and fees is crucial for managing expenses effectively.

APPLY NOW!

Credit Limit Management

Effective credit limit management is a pivotal feature of the Absa Gold Credit Card. Users can tailor their credit limits to suit their financial situation, offering them greater control over their expenditures. The online management tools provided by Absa allow cardholders to monitor spending and adjust limits easily. This flexibility ensures that the card remains a suitable financial tool for various needs, whether for daily expenses or larger purchases. Moreover, Absa provides guidance on managing credit responsibly, encouraging prudent financial habits among its users.

Eligibility and Application

To apply for the Absa Credit Card Gold, individuals must meet specific qualifications and follow a straightforward application process. These prerequisites ensure that applicants can manage the financial responsibilities associated with the card while also providing them with various benefits.

Qualification Criteria

Applicants must be at least 18 years old, confirming their legal eligibility to enter into a credit agreement. Absa requires proof of a minimum monthly income of R4,000. Applicants will need to provide documentation such as a valid South African ID or Smart card, along with recent proof of income for three consecutive months.

Residential eligibility is also considered, so proof of a valid South African residence is necessary. Providing accurate documentation ensures a smoother approval process and helps verify financial stability.

Application Process

The application for the Absa Credit Card Gold can be completed online, offering convenience to potential cardholders. Interested individuals can visit Absa’s website, where they will find detailed instructions and the necessary forms.

Applicants need to ensure that all personal and financial information is accurate to avoid any delays. Upon submission, Absa reviews the application to verify eligibility. Once approved, the cardholder can enjoy various benefits, such as cashback options and access to exclusive lounges. Being prepared with required documentation expedites the approval process and allows applicants to quickly start utilizing their new card.