FNB Credit Card Gold: Unlocking Exclusive Financial Benefits

Anúncios

The FNB Credit Card Gold is designed for individuals seeking a reliable and convenient way to manage their expenses, especially for business managers and sales representatives. It offers a range of perks, including eBucks Rewards, where users can earn 2.5% back on qualifying purchases and up to15% back on fuel, prepaid airtime, and electricity at participating stores.

With features like these, the card presents itself as a practical choice for those looking to optimize their spending habits.

In addition to earning rewards, the FNB Credit Card Gold provides users with opportunities for instant savings and exclusive benefits. The card is structured to support not only personal expenditures but also to cater to business-related financial needs. As users navigate their daily financial activities, this credit card aims to offer a balance of rewards and functionality, aligning with the broader financial solutions offered by FNB.

The card also aims to give peace of mind by featuring secure transactions and simplifying payment processes. With the added advantage of no-cost bundle accounts, cardholders are able to streamline their finances more efficiently. As the FNB Credit Card Gold continues to support its users’ needs, it remains a strong contender for those considering enhancing their financial toolkit with additional benefits and security features.

FNB Credit Card Gold Features and Benefits

The FNB Credit Card Gold stands out with its appealing array of features, designed to enhance customer satisfaction and financial convenience. It offers valuable rewards, robust security measures, competitive interest rates, and flexible credit limit management options.

Rewards Program

FNB Credit Card Gold holders can benefit significantly from the eBucks Rewards for Business program. Customers can earn up to 2.5% back on qualifying purchases, which includes categories like prepaid airtime and electricity. More notably, users can receive up to 15% back on fuel and purchases at Checkers and Shoprite stores.

An important feature of this program is the automatic linkage to eBucks, which simplifies the rewards process. This system incentivizes spending by providing tangible benefits in the form of discounts and savings. Cardholders are also likely to appreciate the personalized nature of the rewards, which align with common spending habits.

Security and Fraud Protection

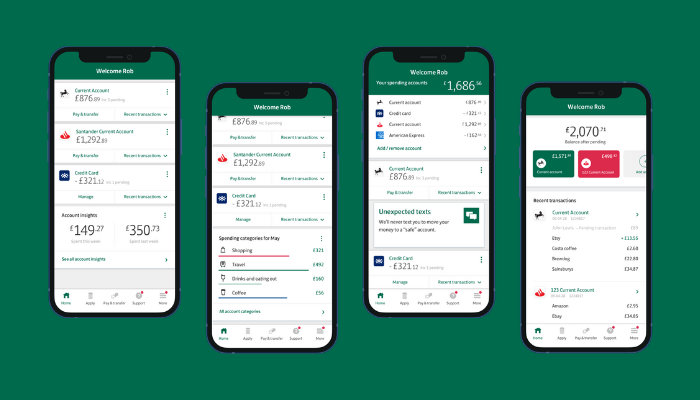

Security is a major focus for FNB in ensuring clients’ peace of mind. The FNB Credit Card Gold integrates advanced security features to protect against fraud. Modern technology, such as Tap and Pay, reduces the need for physical card contact while ensuring transactions are secure.

Moreover, these cards are equipped with fraud monitoring mechanisms. If any unusual activity is detected, FNB swiftly acts to protect the cardholder’s funds. Clients also benefit from the bank’s comprehensive fraud reporting system, which can be accessed through multiple channels, including online banking. Regular communication further aids in keeping customers informed about potential threats and protection strategies.

APPLY NOW!

Credit Limit Management

Flexibility in credit limit management is a highlight of the FNB Credit Card Gold. Customers can manage their credit limits based on personal financial circumstances. The bank evaluates each client’s profile to establish an appropriate limit, ensuring that it meets individual spending capabilities and creditworthiness.

Clients are also able to request changes to their credit limits online, providing additional convenience. This ensures that the card remains a useful tool for managing cash flow, without exceeding limits that could lead to financial strain. By offering such customization, FNB supports responsible spending and financial planning for its customers.

How to Apply for and Manage Your FNB Credit Card Gold

Applying for and managing an FNB Credit Card Gold involves several straightforward steps. Prospective cardholders can benefit from using FNB’s online services and customer support to effectively maintain their account and finances.

Application Process

Individuals interested in the Credit Card Gold must meet specific requirements to apply. Applicants should be at least 18 years old and hold South African citizenship. A good credit score is crucial for approval.

To apply, visit the official FNB Gold Credit Card webpage. Click on the “Apply Now” button to access the online application form. Completing this form requires personal and financial details. Once submitted, the application process includes a review period where FNB assesses the applicant’s financial situation and creditworthiness.