US Bank Credit Card Offers: Rewards and Benefits

Anúncios

Navigating the myriad of credit card options can be an overwhelming task, but if you’re considering a credit card from a longstanding institution, U.S. Bank may have a card that suits your financial habits and goals. With a range of credit cards tailored to fit various lifestyles, U.S. Bank offers you the flexibility to choose from cards that focus on cash back, rewards, low introductory rates, or helping you build your credit.

Whether you’re after a card that rewards you for everyday purchases or one that helps you manage your spending with no annual fee, U.S. Bank provides a spectrum of options.

Effectively managing your credit card is crucial to maintaining financial health. U.S. Bank ensures you’re supported with comprehensive customer service that aids in online management, phone support, setup of alerts, authorized users, autopay, and more. The accessibility to manage your account easily contributes to a seamless banking experience, enabling you to focus on optimizing your financial resources.

Coupled with the convenience of digital banking, U.S. Bank credit cards come with additional perks and benefits. For instance, the U.S. Bank Cash Rewards Visa Card allows you to earn cash back on all purchases without a cap, and the Cash+ Secured Visa offers a secure way to build credit while earning cash back in chosen categories. This adaptability and the variety of rewards available position U.S. Bank credit cards as competitive financial tools in your wallet.

[su_button url=”https://www.usbank.com/index.html” background=”#DA1710″ size=”15″ icon=”icon: credit-card-alt”]APLLY NOW![/su_button]

US Bank Credit Card Offerings

U.S. Bank offers a variety of credit cards tailored to meet the financial needs and preferences of different consumers. From rewards programs to competitive interest rates, explore what U.S. Bank has to offer.

Types of US Bank Credit Cards

U.S. Bank provides several credit card options ranging from cards designed for everyday purchases to those tailored for people looking to build or repair credit. Among these, the U.S. Bank Cash+® Visa Signature® Card stands out for customized cash back rewards. For travelers, cards like the U.S. Bank Altitude® series offer value through points redeemable for travel and other rewards.

Reward Programs

The reward programs associated with U.S. Bank credit cards are diverse and lucrative. For instance, you could earn up to 6% cash back on select categories with the U.S. Bank Cash+® Visa Signature® Card. Additionally, dining and entertainment spending can earn generous rewards with specific cards, making them excellent for food enthusiasts and social spenders.

Interest Rates and Fees

The interest rates and fees associated with U.S. Bank credit cards can vary. Some cards offer a 0% intro APR on purchases and balance transfers for a limited time, which can be highly beneficial for managing large expenses or consolidating debt. To understand all the rates and fees for a particular card, it’s crucial to review the terms and conditions linked to each credit card offering personal banking services from U.S. Bank.

With a focus on providing value through a spectrum of credit card offerings, U.S. Bank accommodates both the reward-seeking customer and the cost-conscious consumer, emphasizing the bank’s dedication to comprehensive financial solutions.

How to Manage Your US Bank Credit Card

Managing your US Bank credit card efficiently requires using the available tools and services designed to help you keep track of your finances. Below, you’ll discover how to utilize online and mobile options, connect with customer service, and benefit from security features.

Online Account Management

To effectively manage your account from anywhere, log in to your US Bank credit card online. You can view your balance, check recent transactions, and make payments. Setting up payment options and due date reminders ensures you’re always on top of your bills. Additionally, account customization features offer you control over how you receive alerts and notifications.

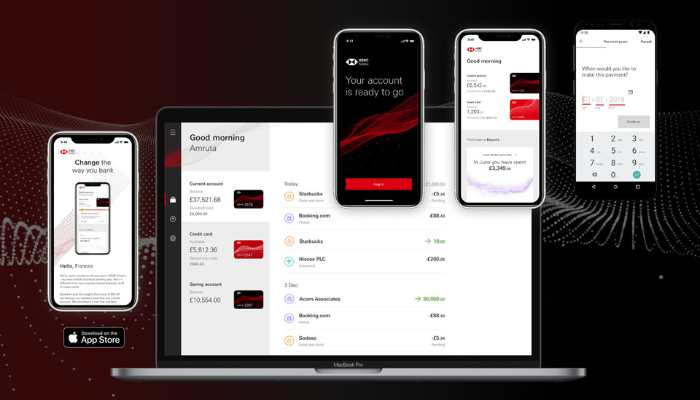

Mobile Banking

With the U.S. Bank mobile app, your credit card management goes wherever you do. Use the app to deposit checks, pay bills, and transfer funds with a few taps. The app provides a secure and convenient way to manage your credit card at your fingertips, along with real-time account alerts to monitor your spending and detect any unauthorized activity quickly.

Customer Service

If you need assistance with any aspect of your credit card, US Bank’s customer service team is around to help. Whether you’re looking to process a balance transfer, dispute a transaction, or have questions about your account, you can reach out via phone, email or live chat for support.

Security Features

Security is paramount when it comes to your credit card. US Bank provides robust security features to protect your account, including fraud monitoring and alerts for unusual activity. Always review your account activity and if you notice any unrecognized charges, contact US Bank immediately using the number on the back of your card.